BV SHRM Legislative Update – Q3 2020

Quarterly legislative updates are provided to alert members to new and emerging developments in the law with the understanding that they are not legal opinion or professional advice on specific facts or matters. For answers to your specific questions, please consult with counsel.

Congress and COVID-19

As the U.S. continues to contend with the COVID-19 pandemic, three major acts have been signed into law since March 6, 2020, including interim legislative responses to fund the depleted Paycheck Protection Program (PPP), provide additional funding for hospitals and testing, and provide more flexibility when using PPP funds and applying for loan forgiveness (H.R. 266 Paycheck Protection Program and Health Care Enhancement Act and H.R. 7010 Paycheck Protection Flexibility Act). Details on the first three acts can be found in the Q2 BV SHRM Legislative Update. A fourth act has been under consideration since the House passed the HEROES Act on May 15; however, this next phase of response is moving more slowly due to differing priorities between Republicans and Democrats.

The Senate has proposed the Health, Economic Assistance, Liability Protection, and Schools (HEALS) Act, which includes business liability protection from COVID-19-related lawsuits, additional Paycheck Protection Program loans for certain qualifying businesses and a second round of stimulus checks. The House cancelled its traditional August recess in an attempt to reach a bill, but the Senate broke for recess, until September 8, before an agreement could be met.

SHRM Legislative and Regulatory Update

The COVID-19 pandemic has provided unique working challenges for many people and organizations, and the Supreme Court of the United States (SCOTUS), is no exception. For the first time since the 1918 Spanish Flu, SCOTUS postponed March oral arguments until April, and then held them remotely in May. Decisions were issued in July for the first time in 24 years. Additionally, for the first time in history, SCOTUS provided live audio of its oral arguments to the public. Recent SCOTUS decisions are summarized below with links to related resources, as available.

Workplace Equity - LGBTQ Non Discrimination

Zarda v. Altitude Express, Inc., Bostock v. Clayton County, EEOC v. RG&GR Harris Funeral Homes, Inc.

In the most anticipated employment decision of the year, the Supreme Court answered, affirmatively, the question of whether sexual orientation and gender identity are included in the definition of sex under Title VII of the Civil Rights Act of 1964. SCOTUS’ decision made it illegal for employers to discriminate on the basis of an employee being gay, lesbian, or transgender. TIP: Employers should review their policies and employee handbook to ensure it complies with the Supreme Court ruling.

Workplace Immigration – DACA

Department of Homeland Security v. Regents of the University of California

The Supreme Court blocked the Trump administration’s attempt to rescind the Deferred Action for Childhood Arrivals (DACA) program, which protects young undocumented immigrants from deportation and allows them to obtain valid work permits. SCOTUS ruled that the administration failed to provide sufficient justification, a violation of the Administrative Procedure Act (APA). DACA recipients may continue to renew membership in the program for now. TIP: Employers that monitor employee status for I-9 purposes should monitor the delays in adjudication of the employment authorization extensions.

Workplace Equity – Equal Pay

Rizo v. Yovino

In April 2020, SHRM submitted an Amicus Brief to the Supreme Court supporting a review of this case and seeking to clarify whether prior salary is “a factor other than sex” that can justify a pay disparity under the federal Equal Pay Act. The request was denied; therefore, the circuit split on this topic remains in place. TIP: Employers should carefully evaluate both federal and state law when deciding whether to consider prior salary while setting pay for any employee.

POSTPONED: Workplace Healthcare – ERISA Pre-emption

Rutledge v. Pharmaceutical Care Management Association

SHRM filed an Amicus Brief with SCOTUS, as did PCMA, and cert. was approved; however, oral arguments have been postponed until October 6 due to COVID-19. Justices will decide whether an Arkansas statute, that regulates the rates charged by pharmacy benefit managers, is pre-empted by the Employee Retirement Income Security Act of 1974 (ERISA). Multistate employers rely on ERISA pre-emption to enable them to create comprehensive benefit plans under a common design that can be applied uniformly across state lines. SHRM is seeking protection for ERISA pre-emption.

In addition to the cases above, SHRM has continued to advocate in the regulatory space, including in the Harvard-MIT lawsuit against DHS USCIS (addressing international students with F-1 visas), the June 22 executive order restricting access to professional visas, support for the J-2 visa program, and support for the Optional Practical Training (OPT) program.

2020 Elections

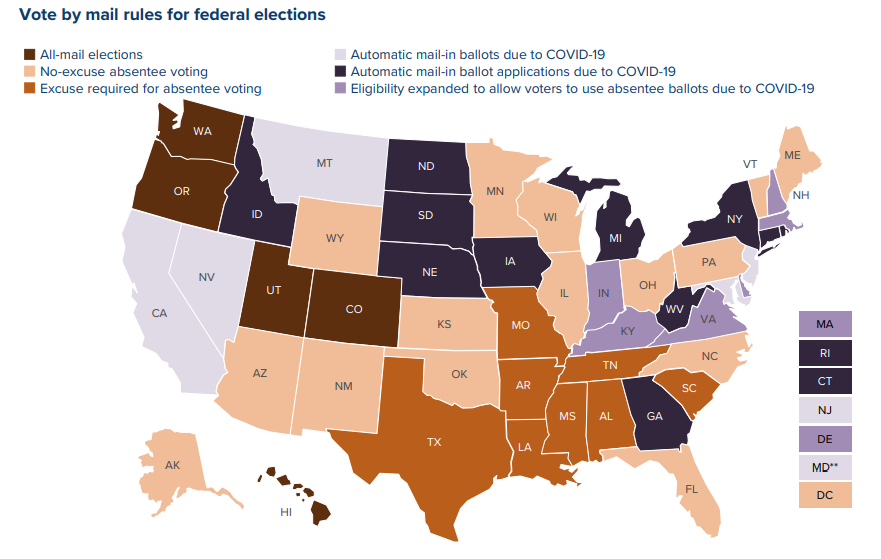

2020 presidential, congressional, and state gubernatorial primaries are underway, with next steps focused on Democratic and Republican National Conventions. SHRM is following closely as candidates present their policy platforms to understand how they may affect workplace policy. SHRM is also watching how COVID-19 will impact the elections. In addition to changes in the primary schedule and digitally focused campaigns, voter turnout may be impacted. State officials are therefore considering expanded voting options in case COVID-19 still poses a threat come November. Expanded voting options include non-excuse absentee (mailed) ballots, excuse-required absentee ballots (such as being out of county, having an illness, or being of elderly age), and early in person voting. A number of states have expanded voting options (graphic current as of July 16).

To increase awareness on voting options and how workplace policy may be affected during the elections, SHRM has created the 2020 Resource Election Center. This one-stop-shop will be built further as the election process moves along.

COVID-19 Compliance News

- Update on Key Changes to the Paycheck Protection Program: Lawmakers extended the application deadline and gave borrowers more flexibility when using funds.

- FFCRA Documentation Rule Struck Down: A federal district court decided against several aspects of the final rule, including employee required documentation before taking FFCRA leave. Clarification is timely as employers can expect an uptick in requests for leave in the first weeks of the school year.

- Congress Passes Coronavirus Relief for Nonprofit Groups: Legislation expected to reduce share of unemployment insurance benefits nonprofit employers must pay upfront for furloughed employees.

- Executive Actions on Unemployment Benefits, Payroll Taxes Promise Relief, Raise Questions:

President Trump directed the Treasury Department to defer payment of the employee portion of Social Security FICA taxes from Sept. 1 through the end of 2020. - As the COVID-19 crisis continues, the DOL, OSHA, and the EEOC have issued additional guidance and answered questions about Return-to-Work Expectations. Click the relevant links for updates.

- DOL provides guidance on tracking telecommuter work hours and whether exempt employees can perform non-exempt duties due to changing business needs as the pandemic continues.

- Departments Issue Further Guidance on Coverage for COVID-19 Testing: DOL, HHS, and Treasury issue new set of FAQs on legislation that requires health plans to cover COVID-19 diagnostic testing without cost-sharing.

- IRS issues further guidance on 401(k) withdrawals, to ease rules put into place under the CARES ACT, and allows midyear enrollment and election changes for health plans and FSAs in response to the COVID-19 pandemic.

- ADA Prohibits Retaliation Against Workers Who Telecommute as Reasonable Accommodation: High risk employees may be entitled, as an accommodation under the Americans with Disabilities Act.

Other Compliance News

- Supreme Court Expands Religious-School Exemption from Civil Rights Laws: Two religious school elementary teachers could not pursue age and disability discrimination claims due to the First Amendment's freedom of religion clauses.

- Justices Uphold Expanded Religious Exemption to Contraceptive Mandate: Lawful exemption for religious objectors from ACA regs that require health plans to include contraceptive coverage.

- High Court: Pension Plan Participants Can’t Sue Funded Plan for ERISA Violations: No right to sue fiduciaries for mismanaging funds because of continued full monthly payments.

- HHS Blocked from Rolling Back Health Care Protections for Transgender Workers: NY federal judge temporarily blocked the removal of certain health care protections for transgender individuals.

- Trump Suspends New H-1B Visas Through 2020: EO restricts foreign nationals from using certain employment-based visas through the end of 2020 and extends green card ban through Dec. 31.

- EEOC to Propose Rule Revising Its Voluntary Dispute Resolution Process: A vote to update its conciliation program that encourages employers to voluntarily resolve discrimination charges.

- In labor news, the DOL has stopped seeking double damages in pre-litigation settlements, has issued an opinion letter clarifying the FLSA administrative exemption, and in one year’s time will begin requiring 401(k) plans to annually provide participants with lifetime income estimates.

- In labor relations news, the NLRB updated election rule changes to comply with a recent court order and is also considering scrapping or modifying the contract bar doctrine, which makes it difficult for employees to vote out unions.

- DOT Implements Temporary Drug-Testing Waiver: A limited drug-testing waiver for commercial drivers, lasting until Sept. 30, intends to relieve cost burdens for testing furloughed drivers.

- U.S.-Mexico-Canada Agreement Introduces Labor Changes: Agreement introduces labor provisions that carry potentially significant consequences for employers operating across borders.

- Departments Propose Keeping Grandfathered Health Plans Alive Longer: Proposed rule would help grandfathered group health plans, exempt from some ACA requirements, hang on a bit longer by allowing increased cost-sharing.

5th Circuit Court Report

- Highly Paid Worker Needed to Regularly Perform Only One FLSA-Exempt Duty to be exempt from overtime pay under the FLSA, even if that duty does not involve exercise of discretion and independent judgment.

- Employee's Daily Hitch Rate Requires Overtime Pay: Employee was not paid on a “salary basis” as defined by the FLSA, so should have been eligible for overtime pay.

- Tax Consultants Were Not Exempt Under the FLSA because they were doing work related to the production of business commodities, rather than assisting in running the business or administering its affairs.

- The Uncertain Future of Texas Paid-Sick-Leave Ordinances: TX Supreme Court refused to review a case that could have decided whether municipal paid-sick-leave ordinances in Texas are lawful.

- Fired Employee Could Not Show FMLA or ADA Violations because she violated an attendance policy when her final absence resulted from her arrest for driving while intoxicated.

In Case You Missed It

- IRS Announces 2021 Limits for HSAs and High-Deductible Health Plans: As announced on May 21, HSA contribution limits for 2021 are going up $50 for self-only coverage and $100 for family coverage.

- DOL Updates FMLA Forms: Certain optional FMLA forms, that employers and workers can use to coordinate leave requests, were updated in June 2020.

- Form I-9 Fines Raised for the Rest of 2020 and Beyond: Increased fines for Form I-9 penalties, in accordance with annual inflation, will be effective for penalties assessed after June 17, 2020 for associated violations which occurred after Nov. 2, 2015.

- Retirement Plan Electronic Disclosure Final Rule: DOL published final rule expanding employers' ability to deliver retirement plan information by e-mail (or text message with links to online documents). The rule took effect July 27.

- FLSA’s Fluctuating Workweek Final Rule Effective: Employers have greater flexibility to use the fluctuating workweek method of calculating overtime pay for salaried, nonexempt workers whose hours vary from week to week. Effective date August 7, 2020.

- Health Care Nondiscrimination Notice Requirement Is Going Away: HHS final rule removes requirements for employers to issue health care nondiscrimination statements and add taglines to employee communications after August 18.

Trending Topics

- Political Discussions at Work: With the upcoming presidential election, how should HR professionals navigate such situations and keep them from becoming toxic?

- How to Talk with Employees About Race: It's hard to know how to address the feelings of anger, despair or frustration that may be percolating among employees at the workplace. But it would be a mistake to stay silent.

- The ADA Turns 30: High rates of unemployment and underemployment remain for people with disabilities, and new barriers to Web accessibility are emerging, but employers can change that.

- What to Do If an Employee Is Arrested During a Peaceful Protest: Should an employer enforce or relax their attendance policies, support employees who participate in protests, or monitor off-duty conduct? Here's what employment attorneys had to say.

- Recall Furloughed Workers Lawfully: Avoid legal hazards as you determine who will return to work and what to communicate in recall letters.

- Maintain Employee Privacy in Video Interviews: Conducting video interviews has become a necessity due to COVID-19, but HR and hiring managers need to be aware of some thorny issues.

Plan Ahead

|

SEPT 19 |

ICE Extends Relaxed Requirements for Form I-9 to Sept. 19: Employers with entirely remote workforces, as a result of COVID-19, have until Sept. 19 to take advantage of relaxed document inspection requirements for Form I-9 when onboarding new hires. |

|

Sept 30 |

VETS-4212 Filing Cycle Ends: VETS-4212 reporting requirements apply to all federal contractors and subcontractors with a government contract in the amount of $150,000 or more at any point during 2019. The deadline for filing the report is Sept. 30. |

|

Oct 2 |

Visa Filing Fees Set to Increase for Employers: Immigration filing fees for most case types will rise for employers of foreign national workers beginning Oct. 2. |

Other Helpful Resources

- For the latest news and advice on handling COVID-19 in the workplace, visit SHRM’s COVID-19 Legislative Response Resource Center.

- SHRM is navigating what’s ahead with the latest research, insights, and tools focused on 5 building blocks for the future of work. Visit Navigating COVID-19: A Toolbox to Build a New World of Work for more information.

- Be in the know for when Congress is in session as well as other key election and advocacy dates with the 2020 Congressional & Election Calendar.

- SHRM’s new advocacy website is centered on five key policy areas and features A-team news, letter writing campaigns, and resources for engaging government leaders all the way to the local level. Visit advocacy.shrm.org for more information and to sign-up for the A-team.

- For a full list of state law reminders and developments, click here.