BV SHRM Legislative Update – Q2 2020

Quarterly legislative updates are provided to alert members to new and emerging developments in the law with the understanding that they are not legal opinion or professional advice on specific facts or matters. For answers to your specific questions, please consult with counsel.

Congress and COVID-19

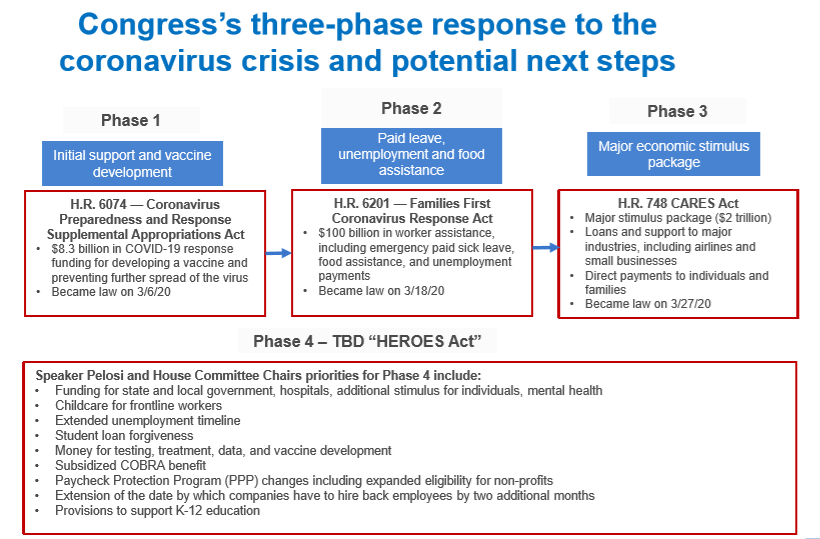

As the U.S. contends with the ongoing COVID-19 pandemic, three separate acts have been signed into law since March 6, 2020, with a fourth package now under consideration by the Senate.

Congress’ Three-Phase Response to the Coronavirus Crisis and Potential Next Steps

Bipartisan agreement on the 4th phase package (CARES II or the HEROES Act) will be difficult to achieve, but SHRM expects the potential for a 5th phase, and possibly a 6th phase package. Potential provisions in future phases could include “fixes” to funding gaps in previous legislation, additional cash payments to individuals, hazard pay for healthcare workers, infrastructure funding and projects, and stabilization funding for states and localities. Given limited floor time, SHRM also expects to see additional major items tacked on to must-pass legislation, such as climate change proposals, drug pricing and surprise billing legislation (for out-of-network healthcare costs), and expansion of internal revenue code 127 (student loan repayment as a benefit). SHRM has long advocated for expanding employer-provided education assistance and will continue to work to make this provision permanent.

To help you navigate this sweeping legislation, SHRM has compiled an in-depth analysis for both the Families First Coronavirus Response Act (FFCRA) and the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). An FFCRA Q&A document is also available. Please click on the highlighted links above to be directed to these resources.

SHRM Priority Issues for COVID-19 Legislation

As congress moves forward with additional legislation, SHRM will be focused on the following priority issues:

- Small Businesses – Congress should authorize additional funding for the Paycheck Protection Program and expand to include all nonprofit organizations.

- Health Care Benefits – Congress should grant employers an additional 60-90 days following the date of the end of the national, state, and local emergencies to respond to IRS 226-J notifications.

- Flexible Spending Accounts (FSAs) – Congress should ensure maximum flexibility for FSAs, such as an extension in grace period and increase in rollover amount.

- Paid Leave – SHRM urges policymakers to avoid imposing additional paid leave requirements that may inadvertently force employers to reduce employment at a time when financial stability is needed most.

- Job Share Programs – Congress should seek to implement a federal framework replicating successful state jobsharing programs to ensure employees have financial stability and access to healthcare during this crisis.

- Unemployment Insurance (UI) – Congress should build on the FFCRA and the CARES Act by authorizing stimulus support to states to offset increased expenses of unemployment benefits.

Expanding the Paycheck Protection Program to include all non-profit organizations impacts SHRM directly. 556 SHRM chapters and 50 state councils are considered 501(c)(6) organizations, which are currently excluded from this program. Many of our chapters and councils are experiencing hardship during this time too. SHRM is therefore advocating for all non-profits to be included in emergency assistance legislation. You can join SHRM and make your voice heard today by visiting shrm.org/protect-chapters.

COVID-19 Compliance News

Medical Screenings, Safety Measures, and Accommodations

- EEOC Updates COVID-19 Guidance: Asking employees about symptoms, implementing safety measures, and mandatory testing: What you should know about COVID-19 and the ADA, the Rehabilitation Act, and other EEO laws.

- A Guide to Employee Temperature Checks: EEOC greenlights employee temperature checks, but what does that mean for employers in practice?

- How to Accommodate At-Risk Workers: Defining “at-risk” and what to do if an employee asks for an accommodation (or doesn’t ask, but notice of a medical condition has been made).

- Don’t Overlook NLRA Rights During Coronavirus Outbreak: Did you know that any concerted activity designed to increase workplace safety during the pandemic could be protected for both unionized and nonunionized employees?

Furloughs, Layoffs and Pay Cuts

- Weathering Coronavirus: Furloughs, Layoffs or Pay Cuts?: Business leaders must work through a myriad of strategic considerations and complex laws governing pay, benefits and notice requirements.

- DOL Issues COVID-19 WARN Act Guidance: Can employers claim an exemption from WARN for terminations caused by COVID-19?

- Use Caution When Cutting an Exempt Employee’s Salary: Salary cuts must adhere to federal and state wage and hour laws.

- Unemployment Work Share Programs as an Alternative to Layoffs: Understand the benefits to employers and employees of temporarily reducing hours and corresponding wages.

Implications for Remote Work

- DHS Relaxes Form I-9 Review Requirements: Requirements for in-person document review deferred for employers and workplaces that are operating completely remotely.

- Remote Work and State Taxes: Don’t forget that telecommuting can have special state tax implications.

Reporting Requirements Updates

- EEOC Won’t Collect Employer EEO-1 Data in 2020 Due to Coronavirus: EEO-1 Component 1 information delayed until March 2021.

- With New Guidance, OSHA Scales Back COVID-19 Reporting Requirements: Employers are relieved of some responsibility for investigating and recording COVID-19 cases among employees, but still must record those that are obviously work-related.

- OFCCP’s Coronavirus Exemption Has Supporters and Critics: OFCCP temporarily waives affirmative action requirements for coronavirus-relief contracts.

Benefits Impacts

- COBRA Election and Payment Deadlines Extended: Are you and your employees aware of the temporary period extension for electing COBRA and the new deadline to start making premium payments?

- Benefit Plan Deadline Extensions: IRS and DOL extended deadlines for Form 5500 and certain ERISA notice and disclosure requirements.

Other Compliance News

- Proposed State-Sponsored Visas Affirm a Skills-Based Approach to Immigration: New immigration reform proposal would create pilot program for states to sponsor renewable three-year visas based on employment needs.

- State Laws Vary on Time Off to Vote: With presidential primaries underway, ensure you’re in compliance with state laws on employee voting rights and notice posting.

- 9th Circuit Says Prior Salary Can’t Justify Gender Pay Disparity: Employers should consider how big of a role—if any—a job applicant's compensation history should play in setting compensation.

- Texas Firefighter Opposed to Vaccination Loses Discrimination Claim: 5th circuit ruled employee could not establish religious discrimination after refusing vaccination on religious grounds and subsequent offer of transfer or additional safety equipment.

- NLRB Makes Voting Out Unions Easier: Final ruling will make it easier for unionized workers, who are dissatisfied with their unions, to vote them out. Effective date has been delayed until July 31.

Trending Topics

- ‘OK Boomer’ and ‘Lazy Millennial’ Shouldn’t Be Ignored: Age-related putdowns can create tension and real problems in workplaces dealing with intergenerational conflict.

- Should Employers Let Workers Text That They're Off for FMLA?: Some employees prefer to communicate via text. Adopt reasonable requirements and communicate them well.

- NDAs: Boon or Bane: Do nondisclosure agreements (NDAs) in sexual harassment situations do more damage than good?

- Supporting Mental Health Amid Uncertainty: Depression, bipolar disorder, anxiety disorders and other impairments can rise to the level of disabilities.

In Case You Missed It

- DOL Issues Workplace Posters on Employees’ Right to Paid Coronavirus Leave: Employers were required to post notices or e-mail them to current employees by April 1.

- NLRB Issues New Definition of ‘Joint Employer’: Final rule restored the joint-employer standard, but with greater precision, clarity, and detail. The new definition became effective April 27.

- Deadline to Start Using New Form I-9: New edition I-9 form lists additional countries in section 1, among other minor changes visible when completing the electronic version. Employers were required to begin using the new version no later than May 1.

Other Helpful Resources

- For the latest news and advice on handling COVID-19 in the workplace, visit SHRM’s COVID-19 Legislative Response Resource Center.

- SHRM is navigating what’s ahead with the latest research, insights, and tools focused on 5 building blocks for the future of work. Visit Navigating COVID-19: A Toolbox to Build a New World of Work for more information.

- SHRM’s new advocacy website is centered around five key policy areas and features A-team news, letter writing campaigns, and resources for engaging government leaders all the way to the local level. Visit advocacy.shrm.org for more information and to sign-up for the A-team.

- For a full list of state law reminders and developments, click here.

- Be in the know for when Congress is in session as well as other key election and advocacy dates with the 2020 Congressional & Election Calendar.